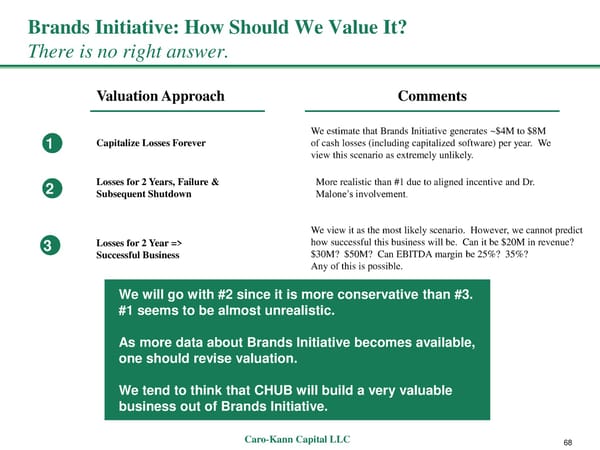

Brands Initiative: How Should We Value It? There is no right answer. Valuation Approach Comments We estimate that Brands Initiative generates ~$4M to $8M 1 Capitalize Losses Forever of cash losses (including capitalized software) per year. We view this scenario as extremely unlikely. 2 Losses for 2 Years, Failure & More realistic than #1 due to aligned incentive and Dr. Subsequent Shutdown Malone’s involvement. We view it as the most likely scenario. However, we cannot predict 3 Losses for 2 Year => how successful this business will be. Can it be $20M in revenue? Successful Business $30M? $50M? Can EBITDA margin be 25%? 35%? Any of this is possible. We will go with #2 since it is more conservative than #3. #1 seems to be almost unrealistic. As more data about Brands Initiative becomes available, one should revise valuation. We tend to think that CHUB will build a very valuable business out of Brands Initiative. Caro-Kann Capital LLC 68

CommerceHub: Uniquely Levered to E-Commerce Growth Page 68 Page 70

CommerceHub: Uniquely Levered to E-Commerce Growth Page 68 Page 70